Finance Engagement

We support ESG investors and financial institutions to invest in and finance an advanced sustainable and responsible seafood industry

Recommended for

-

Those who want to have the latest information about seafood sustainability at global financial institution

-

Those who want to eliminate risks derived from overfishing, IUU (illegal, unreported, unregulated) fishing, or human rights violations from the portfolio

-

Those who want to engage with investment and financing to improve sustainability in the seafood industry

Roadmap for ESG investment and financing in fisheries

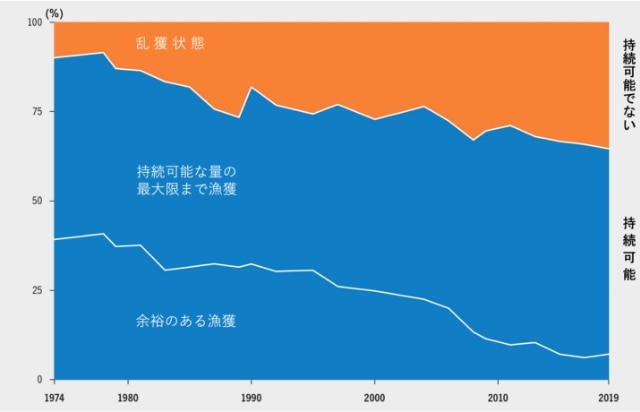

Understand the systemic risks posed by overfishing, IUU fishing, and human rights violations that threaten sustainability in the seafood industry

At Seafood Legacy, we provide ESG investors and financial institutions in Japan with a wealth of knowledge about the current state of the seafood market in Japan and the risks facing its global supply chain.

Overfishing

IUU fishing

Human rights violations

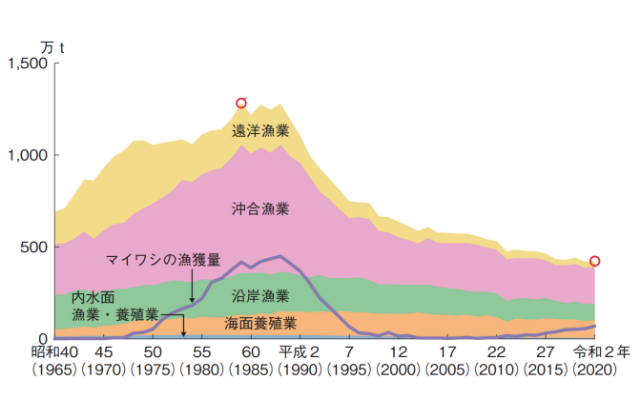

Current state of Japan’s seafood industry

Know case studies, international collaboration, and global trends of ESG investment and financing in fisheries

According to the article “The future of food from the sea,” published in Nature in 2020, the oceans will play an important role in providing food in 2050 when the global population reaches 9.8 billion. If sustainable production systems are successfully built, it is estimated that edible seafood derived from the ocean will increase from the current 59 million tons to 130 million tons. Aquaculture has the potential to expand to 44% of total production volume if alternative feeds are developed.

As the United Nations, governments, corporations, and investors increasingly pursue biodiversity conservation for the oceans and food security, Seafood Legacy will organize seminars for institutions involved in ESG investment and financing in Japan to provide the latest information on international platforms, benchmarks, and initiatives by leading institutions in Japan and abroad.

The Sustainable Blue Economy Finance Principles and Guidance

Analysis of the risks and opportunities for financial institutions investing in and financing the sustainable blue economy. Prepared by the UN Environment Programme Finance Initiative (UNEP-FI) and other organizations.

Click here for Principles and Guidance in English

Click here for Japanese translation (Seafood sector, excerpt)

The Index of 30 Global Seafood Companies’ Sustainability

Assessment by the World Benchmarking Alliance (WBA) based on four indicators: Governance and strategy, Biodiversity conservation, Traceability and IUU, and Social responsibility (in English)

Click here

ESG Evaluation of Animal Protein Producers

Coller FAIRR assessment of animal protein producers from the ESG perspective, including climate change, deforestation, animal welfare and working conditions. (In English) Click here

Assessment of 70 Listed Japanese Companies

Asia Sustainable Finance Initiative

The organization supports the financial sector to better understand the risks and opportunities of ESG investment, and to harness their power to achieve the SDGs. (Click here)

Tokyo Sustainable Seafood Summit

Formulation of codes of conduct, monitoring, engagement and disclosure for ESG investment and financing in the seafood industry

Seafood Legacy provides ESG investors and financial institutions with a full range of support on formulation of codes of conduct, monitoring, engagement and disclosure when investing in and financing the seafood industry.

Partner Organizations

- WWF: https://www.wwf.or.jp/

- UNEP-FI: https://www.unepfi.org/

- WBA: https://www.worldbenchmarkingalliance.org/

- Planet Tracker: https://planet-tracker.org/

- FAIRR: https://www.fairr.org/

and more

Reports

Other Services

Market Transformation

We provide planning support from formulating sustainable procurement policies for seafood to distribution and marketing strategies that are in line with the latest international standards.

Policy Reform

As stakeholders, we participate in regulatory reform and policy implementation aimed at sustainable and responsible management of fisheries resources and seafood distribution by governments and international organizations.