What Institutional Investors Are Expecting – Report on the FAIRR Seafood Traceability Engagement Seminar

FAIRR is a global investor network focused on helping investors to better manage risks and opportunities in the food sector. It seeks to raise awareness of environmental and social risks and opportunities across business activities and supply chains within the food industry. The initiative includes 450 participating institutional investors, collectively managing assets totaling USD 75 trillion, giving it substantial influence in the financial and corporate sectors..

In 2024, FAIRR launched the Seafood Traceability Engagement in collaboration with WWF, the United Nations Environment Programme Finance Initiative (UNEP FI), the World Benchmarking Alliance, and Planet Tracker. The engagement focused on seven global seafood companies, including four based in Japan, with the aim of supporting their commitments and implementation of traceability across their supply chains. The ultimate goal is to eliminate overfishing, illegal practices, and biodiversity loss from seafood value chains.

Phase 1 of this engagement successfully concluded at the end of 2024, with active participation from all seven companies and 35 institutions investors.. In March 2025, representatives from FAIRR and WWF visited Japan to present the engagement outcomes at a hybrid-format seminar hosted by Seafood Legacy. The event attracted over 120 registrants, including major Japanese seafood companies and financial institutions.

<Participating Companies in the FAIRR Seafood Traceability Engagement>

Japanese Companies: Nippon Suisan Kaisha, Ltd., Maruha Nichiro Corporation, Marubeni Corporation, Mitsubishi Corporation

International Companies:Charoen Pokphand Foods Pcl (CP Foods) (Thailand), Nomad Foods Ltd (UK)、Thai Union Pcl (Thailand)

The findings of the FAIRR Seafood Traceability Engagement underscore both the risks of delay, and the benefits seafood companies – especially key Japanese seafood companies - can experience by implementing robust traceability systems.

How Investors View their investment portfolios’ dependencies and impacts on nature, and the associated risks and opportunities

Second from the left: Max Boucher, Senior Manager for Biodiversity & Oceans Research, FAIRR

Max Boucher of FAIRR presented the outcomes of the engagement and explained how investors assess and manage their portfolios’ nature and biodiversity dependencies and impacts on nature, along with the associated risks and opportunities.

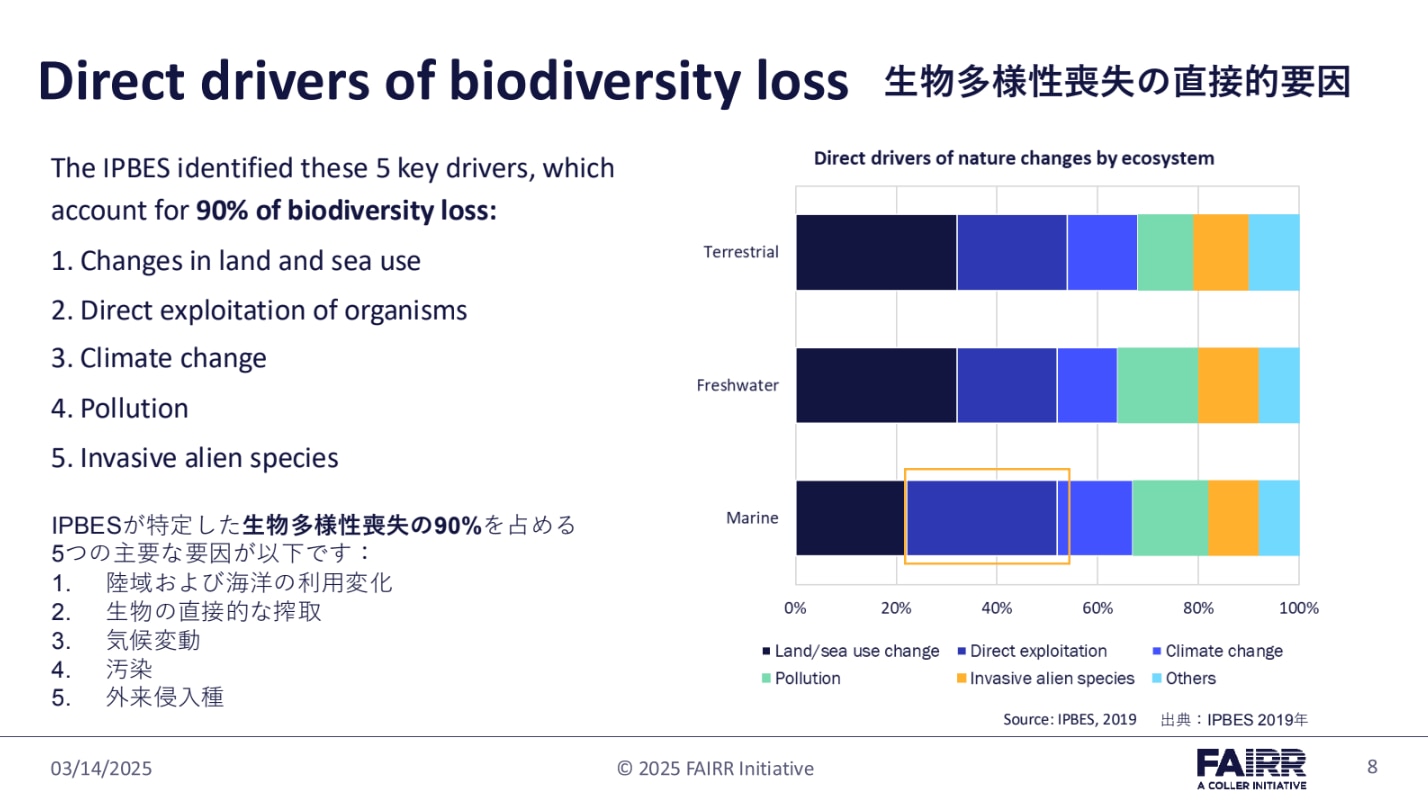

According to Boucher, investors begin by identifying the main drivers that affect biodiversity. This analysis is grounded in scientific sources such as the Intergovernmental Science-Policy Platform on Biodiversity and Ecosystem Services (IPBES).

Based on such data, investors evaluate how their portfolios may depend on and impact nature and biodiversity. For example, they identify invested companies that contribute to biodiversity loss or are exposed to related risks..

Investors then “translate” these risks into financial terms. For instance, if certain fish stocks decline, companies that depend on selling those species may see long-term revenue impacts. Stricter regulations may also negatively affect financial performance. On the other hand, companies committed to sustainability could unlock positive opportunities such as commanding premium prices or gaining competitive advantages by staying ahead of regulatory requirements.

Boucher noted, “Through Phase 1 of the engagement, we gained a clearer understanding of the challenges in implementing traceability.” He pointed out that there are limits to what companies can achieve on their own, and highlighted that FAIRR is working with industry associations to support the development of shared platforms that multiple seafood companies can use collaboratively.

Identifying the drivers of biodiversity loss based on scientific data

(excerpt from seminar presentation slides)

Growing Financial Sector Interest in sustainable management of Ocean Resources

Second from the right: Lauren Lynch, Manager of Blue Finance, WWF-US

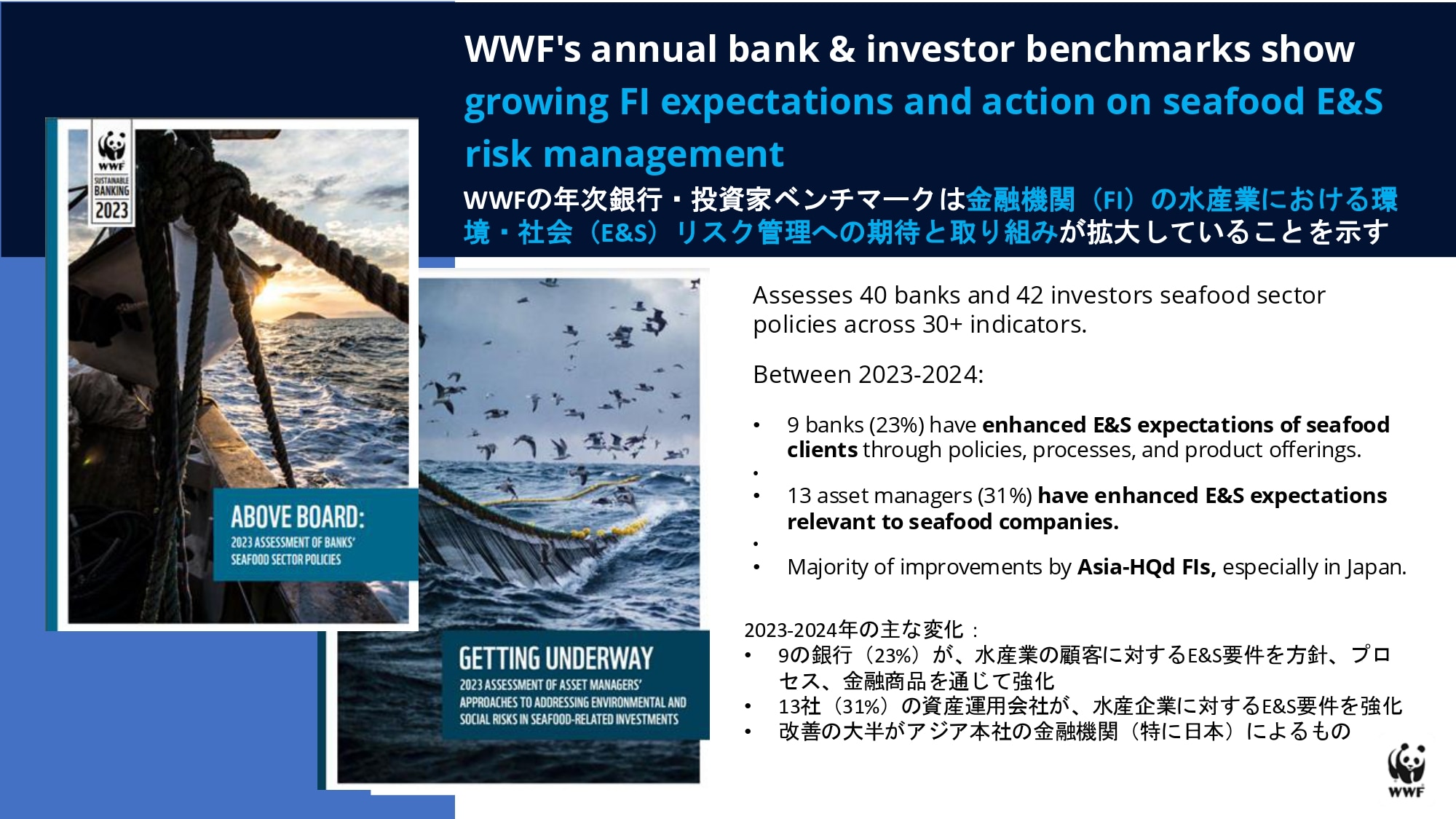

Since 2022, WWF has been assessing the policy landscape for the seafood sector across approximately 80 financial institutions, including banks and asset managers.

Lauren Lynch, who leads blue finance at WWF-US, reflected on the changes demonstrably observed over the past two years of assessments. She noted a clear rise in financial institutions’ awareness of sustainable fisheries. In the 2023 survey, about one-quarter of the 40 banks assessed strengthened their environmental and social (E&S) requirements for the seafood sector as a result of WWF’s engagement. Preliminary analysis of 2024 progress—set to be published in mid-2025—suggests that this positive trend is continuing. A notable example is Mizuho Bank developed a new seafood policy in 2024, marking a significant step forward in Japan.

Investors are also increasingly interested in how companies are addressing nature-related risks. In response, WWF plans to support Phase 2 of the engagement with new initiatives, including the development of guidance for stepwise implementation of traceability and quantification of the added value that such systems can deliver.

Lynch concluded by introducing WWF’s upcoming “a Nature Positive Oceans Framework”, to be published later this year. She emphasized that it’s not only about reducing risk, but also about restoring ecosystems, building resilience, and driving systemic transformation. “Our goal is to ensure this framework is practical , shaped by feedback from companies and investors,” she stated.

WWF’s survey confirms growing financial sector awareness of fisheries sustainability

(excerpt from seminar presentation slides)

A New Era Where “Credibility” Is Demanded in Sustainability Efforts

Far right: Raymond Dhirani, Head of Capital Markets Outreach, MSC & ASC

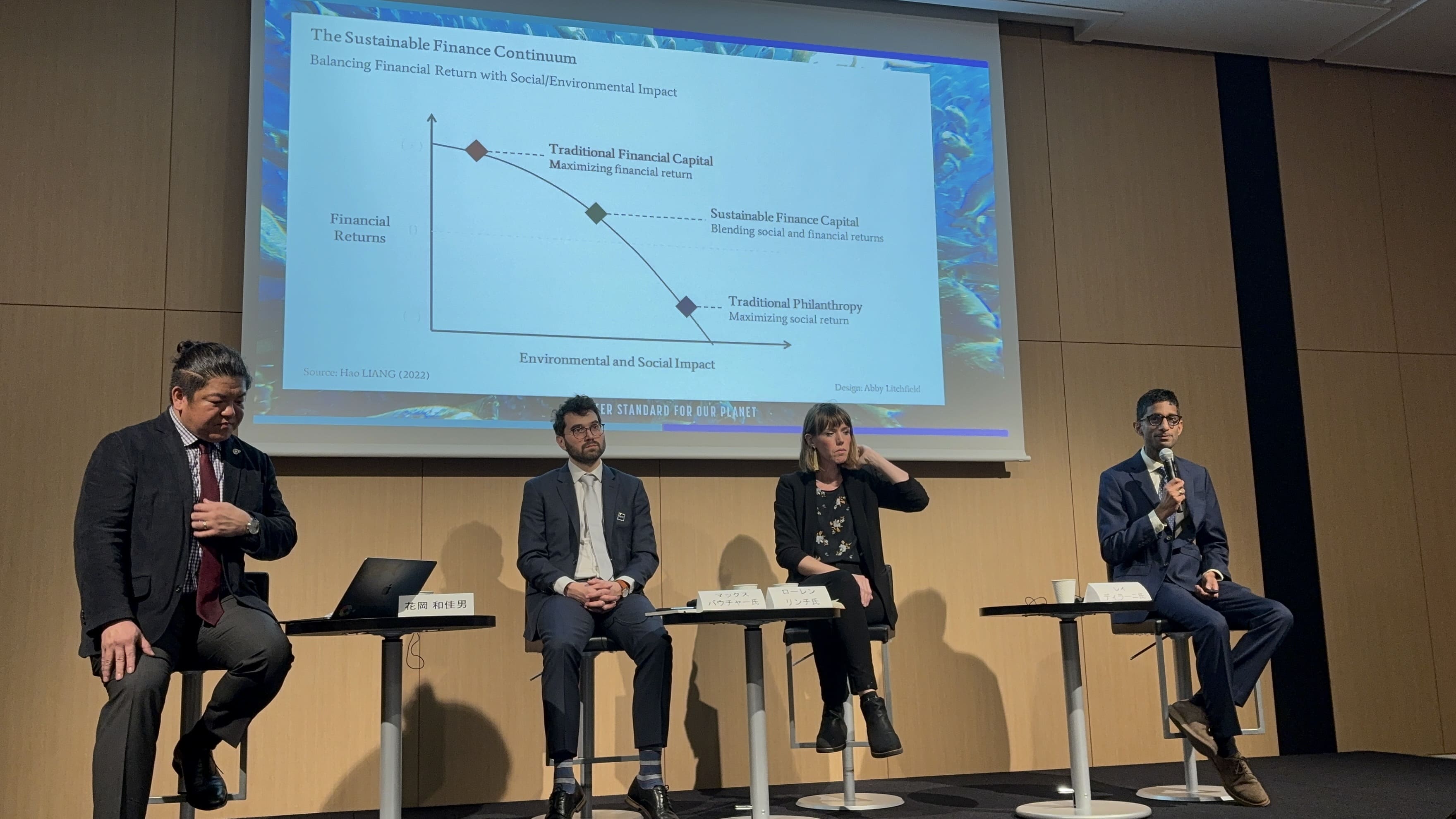

“Financial institutions have shifted rapidly in recent years toward balancing financial returns with environmental and social returns,” said Raymond Dhirani, who oversees engagement with financial institutions at the Marine Stewardship Council (MSC) and the Aquaculture Stewardship Council (ASC).

He stressed that we are now in an era where credibility in sustainability claims is essential. It is no longer sufficient for companies to simply claim themselves sustainable - they must present data, and certification plays a critical role in doing so.

Through engagement with the finance sector, MSC and ASC have been working to embed their standards into investment and lending policies. One notable step forward is Deutsche Bank’s 2024 policy update, which requires marine aquaculture companies to hold or commit to obtaining ASC certification, without exceptions.

In their investor engagement efforts, MSC and ASC promote systems where certified companies are recognized and rewarded by investors. They are also developing an ESG dashboard that visualizes and compares corporate environmental and social performance using MSC/ASC audit data.

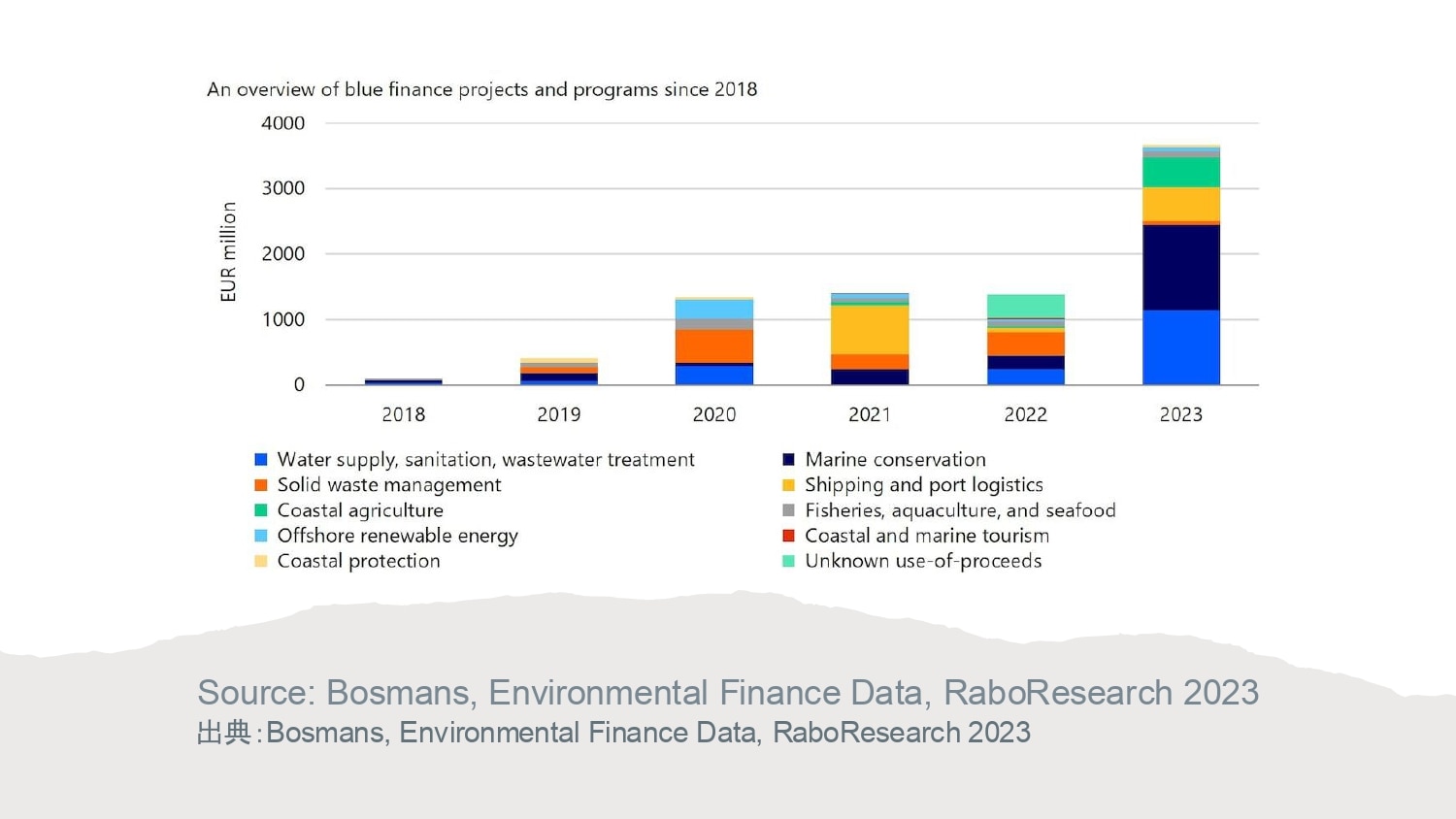

Dhirani also highlighted the rapid growth of the blue finance market, which expanded from virtually zero in 2018 to approximately USD 4 billion by 2023. He concluded by stating, “We aim to drive impact through sustainable finance and help build a better future for the seafood industry.”

(Caption)Since 2018, the blue finance market has grown rapidly (excerpt from seminar slides)

Seafood Traceability: A Topic Investors Can No Longer Ignore

(Caption)Background screen: Dai Yamawaki, Senior Portfolio Manager, Responsible Investment Research Dept. & Net Zero Strategy Office, Nomura Asset Management

Speaking online, Dai Yamawaki of Nomura Asset Management remarked, “Asset owners are becoming more aware of natural capital. Moving forward, investment solutions that align natural capital with financial returns will be in demand.”

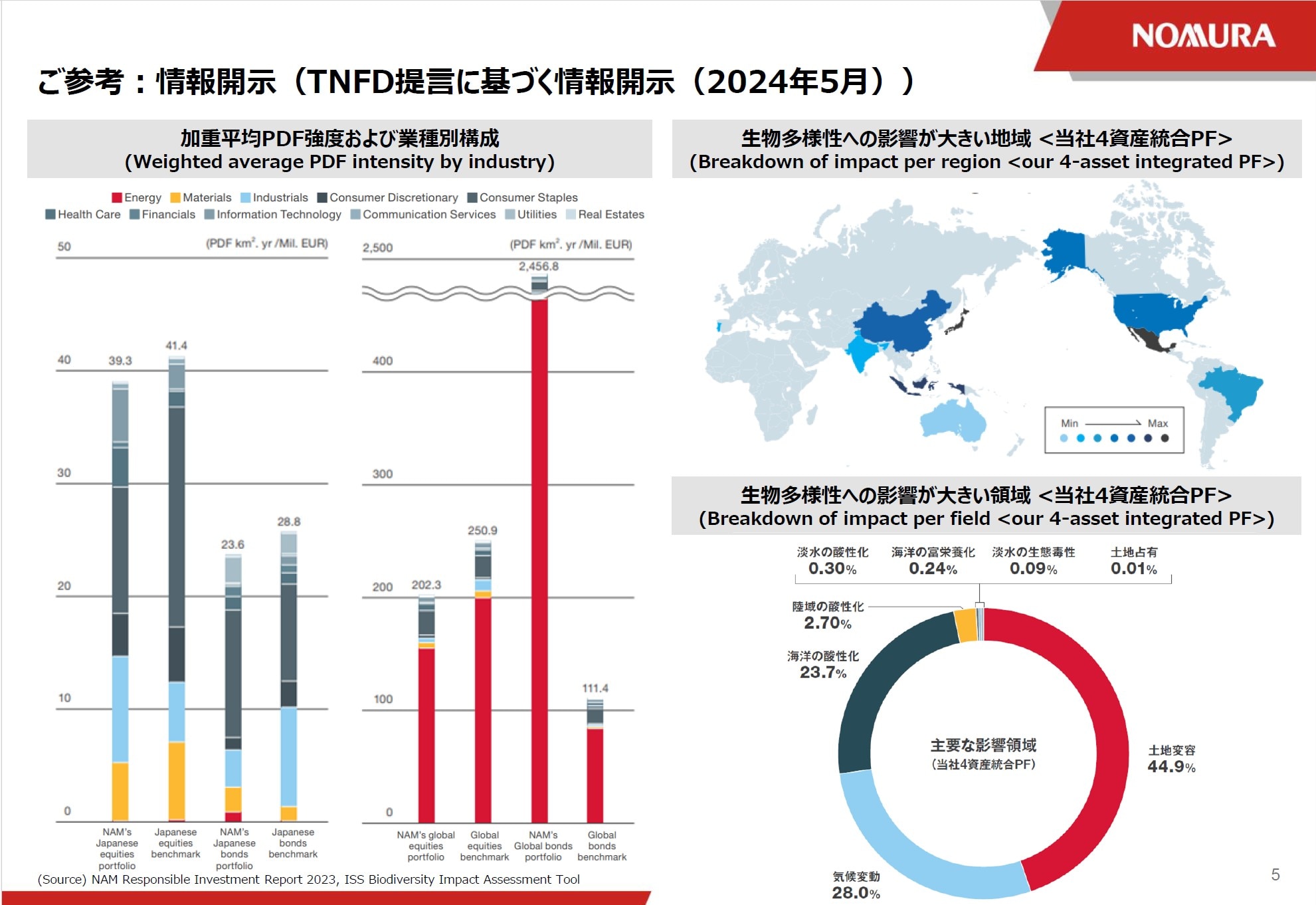

Nomura Asset Management, acting as a lead investor, joined the engagement as a responsible investor with a deep understanding of Japan’s seafood industry and market dynamics. The company regards the seafood sector as a priority. In its 2024 disclosure aligned with the TNFD recommendations, Nomura identified seafood as a key source of natural capital risk in its portfolio.

Yamawaki emphasized that seafood traceability has become “a critical topic that investors can no longer ignore.” While traceability in Japan was historically linked to food safety, the current global environmental and human rights trends have shifted the conversation “from safety to security.”

The engagement revealed various challenges, including the need to build internal systems for data collection. Companies also noted the difficulty of enhancing traceability due to the sheer number of species involved, and in cases where seafood comprises only a small part of the business, gaining internal buy-in was reported as a hurdle. Yamawaki concluded, “We hope to collaborate with other investors and industry associations to move forward together.”

Nomura Asset Management’s TNFD-aligned disclosure identified “ocean health” as a key impact area (excerpt from presentation slides)

Strengthening Seafood Traceability through the Combined Roles of Corporates, Investors, and Governments

In the latter half of the seminar, three on-site panelists responded to questions from both in-person and online participants. The discussion was moderated by Kazuo Hanaoka, President & CEO of Seafood Legacy Co., Ltd. Below is an excerpt of the discussion:

Q: What was your impression of Japanese seafood companies’ engagement?

- We found Japanese companies to be cooperative. In one case, over 15 executives, including the CEO, attended the dialogue, showing how seriously the topic is being taken. Japanese firms are also early movers when it comes to TNFD. They’ve started identifying what they do and don’t understand—this is an essential step. For example, recognizing the proportion of seafood with unknown origin is the first move toward transparency. From awareness to action, we hope to see progress toward building traceability systems. (Boucher, FAIRR)

- The seven companies involved in this engagement are already taking steps toward sustainability—they are industry leaders. This initiative aims to help them collaboratively create best practices that can influence the wider sector. Moving from planning to implementation in the next phase will be critical. (Lynch, WWF)

- Each company’s level of enthusiasm for investor engagement varies. Some already see sustainability as a core issue, and investor voices reinforce their efforts. Others continue operating as they always have. For those companies, it’s important to convey that sustainable business models are tied to long-term shareholder value. Initiatives like this are meaningful because they convey the perspective of sustainability-focused investors. (Dhirani, MSC/ASC)

- From my perspective in Japan, I feel that in the past, the seafood sector as a whole tended to overlook current risks. But today, it’s clear we’re no longer in an era where negative information can be hidden. As the panelists mentioned, it’s evident that a group of leading companies is pulling the industry forward. (Hanaoka, Seafood Legacy)

Q. How do the initiatives by FAIRR, WWF, and MSC/ASC contribute to more transparent disclosure and stronger engagement?

- Traceability, certification, and disclosure are each important tools, but none can solve challenges on their own. When integrated, however, they become powerful mechanisms for transitioning the seafood value chain toward sustainability. We aim to build a narrative that connects these elements holistically. (Lynch, WWF)

- High-quality certification schemes include traceability components and are closely tied to transparent engagement. Disclosure mechanisms like TNFD are not ends in themselves—they are tools that enable financial institutions to understand and respond to risks. Disclosures should influence executive decision-making and accelerate systemic transformation. (Dhirani, MSC/ASC)

-

Investors begin by confirming whether a company conducts proper risk assessments. Disclosure frameworks help prevent situations where “lack of data means unknown risk.” Setting targets and developing strategies based on data is a fundamental step for companies. Certification and traceability can serve as tools to support those strategies. (Boucher, FAIRR) -

In Japan, an increasing number of companies are identifying their dependencies and impacts on nature, evaluating related risks and opportunities, and clarifying their commitment to conservation and restoration. These companies have come to realize that there are limits to what can be achieved within a single business or supply chain. That’s why, in 2024, some of them began jointly calling on the government to strengthen legal frameworks. We’re witnessing a major shift from voluntary to mandatory action. (Hanaoka Seafood Legacy)

Q. How can we establish systems to recognize and fund the sustainable efforts of small-scale fishers?

Certification can indeed be a hurdle for small-scale fisheries. That’s why MSC launched its Improvement Program last year. It’s designed to help these fishers enhance their sustainability performance using the MSC standard, even if they aren’t seeking full certification. We encourage them to reach out and explore how the program can support their efforts. (Dhirani, MSC)

WWF has established the Fisheries Improvement Fund, which incorporates a small premium fee per ton. This mechanism enables consumers and buyers to support small-scale fishers who are working to improve sustainability. Through financial incentives, we are helping accelerate positive change. (Lynch, WWF)

-

Small-scale fishers often lack the financial and technical resources needed. One solution is incentive structures created by larger companies. For example, some aquaculture firms offer premium prices to feed suppliers who meet sustainability standards. The government also has a key role to play by reforming ineffective subsidies and redirecting them to support sustainable fisheries. (Boucher, FAIRR)

Subsidy reform is equally important in Japan. Current schemes have contributed to the continued decline of marine resources, fishery workers, and coastal communities, and they often hinder the flow of investment and lending to small-scale fishers. Subsidies should be conditional on sustainability criteria, with clear quantitative targets for conserving biodiversity and restoring fish stocks. (Hanaoka, Seafood Legacy)

Q. In light of climate change and declining fishery resources, supply chain resilience is increasingly under scrutiny. Should financial institutions also be investing to support resilience?

- There is growing interest in this area. The concept of a just transition is also highly relevant to fisheries. For example, the habitat range of lobsters off the coast of New England in the U.S. is expected to shift northward. It is essential to invest in helping current fishers adapt so they can continue their commercial activities, thereby building resilience. (Boucher, FAIRR)

Q. The Phase 1 results revealed a lack of awareness about traceability among Japanese corporate executives. Any tips for raising awareness?

- Japan’s corporate governance landscape is evolving rapidly. A decade ago, there was minimal dialogue between foreign investors and Japanese companies. But recent reforms by the government and the Tokyo Stock Exchange have accelerated engagement, especially around sustainability. The speed at which this dialogue has expanded in just a few years is encouraging. (Boucher, FAIRR)

- When we decided to center the engagement around traceability, we weren’t sure how much investor interest it would draw. But it exceeded expectations, with 35 investors participating. Even more are expected to join in Phase 2, which reflects the rising importance of traceability dialogue, not just for seafood but also for other commodities. Interest will likely continue to grow. (Lynch, WWF)

- Japanese companies make up one-quarter of all TNFD Early Adopters—organizations that have committed to aligning their 2024 or 2025 disclosures with TNFD recommendations, making Japan the top country globally. In the seafood sector as well, as disclosure becomes more widespread, traceability will be an essential tool for collecting the necessary information. (Hanaoka, Seafood Legacy)

- Issues like human trafficking and forced labor are gaining increasing attention in the seafood sector. To properly conduct human rights due diligence in the supply chain—accurately identifying and assessing risks and implementing effective prevention and mitigation measures—high-quality traceability is essential. (Hanaoka, Seafood Legacy)

The panelists concluded by encouraging financial institutions to join Phase 2 of the FAIRR Seafood Traceability Engagement. Phase 2 will include a second round of corporate engagement in the latter half of 2025, following up on last year’s dialogues.

In closing, Hanaoka said: “While we often focus on risks, it’s just as important—if not more so—to recognize the opportunities. I believe that if financial institutions and seafood companies work together, we can turn challenges into opportunities.”

<What is FAIRR?>

FAIRR stands for Farm Animal Investment Risk and Return. Founded in 2015, it is an institutional investor initiative aimed at increasing awareness of environmental and social risks, as well as opportunities, in the global food sector. The initiative now includes 450 institutional investors, collectively managing USD 75 trillion in assets.